BOS as the main back-office system for an application that handles millions of transactions per month

Our client is one of the dynamically developing European fintechs that offers a payment application with a virtual payment card. As part of the application, our client provides, among others exchange of currencies on attractive terms, multi-currency payment cards, insurance for online shopping, with a guarantee of immediate cashback in the event of a return of goods, as well as cashback for transactions in partner retail chains. In this project, INCAT acts as a technology partner and supplier of the main transaction system.

What is BOS?

BOS is a comprehensive transaction system based on the microservice architecture, dedicated to fintechs and modern financial institutions, such as challenger banks, digital banks and neo-banks. In the architecture of a financial institution, BOS acts as the customer's data and transaction processing center, at the same time giving the possibility to implement financial products, attractive from the end customer's perspective.

Our system enables the implementation and launch of the back-end layer in the client's application or solution, including transaction, payment and account modules, while maintaining the highest compliance with regulatory and cybersecurity requirements.

What were the client's needs?

In order to be able to offer his solution on the commercial market, the client needed a highly scalable transaction system that would enable rapid growth and would meet the rapidly growing number of transactions and application clients, without downtime and in accordance with the requirements set by the legislator.

In addition to the above, the client's requirements included addressing all back-office functionalities required for keeping clients' accounts and providing payment services, along with the possibility of the fastest possible functional and product development.

BOS' s role in this project

The functionalities of BOS address all business and technical requirements of the client, and the architecture of microservices allows for high flexibility in terms of the development of the financial offer. BOS's modern product modules support the creation of a client's offer and building a business and marketing advantage on the commercial financial market.

The biggest challenge of implementation

The biggest challenge while working on the project was the wide range of functionalities that had to be implemented, as well as the need to integrate with external modules in such a way as to comprehensively aggregate data within the General Ledger. We were able to address these requirements in accordance with the client's expectations, using the full potential of the BOS system and its multitude of business and technological possibilities.

Key areas of customer business support

1. Processing of customer data

2. Account management

3. Processing transfers and payments

4. Full functionality of the General Ledger

5. Currency Cascade - a product module that enables efficient currency exchange and payments in multiple currencies within the application

6. Cashback - a module that enables the launch of an affiliate program, offering refunds for purchases made in stores of the affiliate network.

Effects

Thanks to the implementation of BOS, the client obtained:

● A fully functional back-office module of the payment application

● Meeting high performance requirements of several million monthly transactions

● Possibility of product development based on the BOS microservices architecture

● Product module: cashback, currency cascade

● Full integration with the General Ledger

● System compliance with regulatory and safety requirements

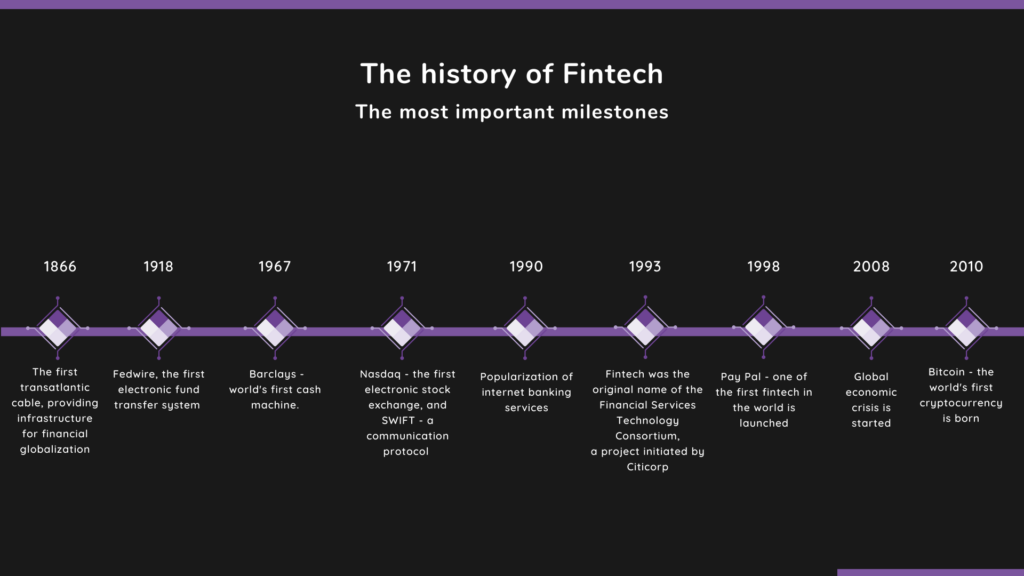

The short story of fintech

Fintechs, treated as modern financial entities, seem to be a relatively new invention in the banking world, although the foundations for this area of business were established in ... the 19th century. Before you, the history of fintech: from the creation of the first transatlantic link to innovative financial startups, without which today's financial landscape would not be complete.

XIX century - the beginning

We know that dating the beginnings of the fintech industry to the nineteenth century may seem "a bit" strange daring, but indeed the year 1866 laid the foundations for the development of this branch of the economy. It was this year that the first transatlantic link was successfully laid, providing the basic infrastructure for the period of intense financial globalization that will take place soon - right at the beginning of the 20th century.

The first half of the 20th century

1918 is not only the end of military operations under the First World War, but also the time of intensive development of technologies, especially telecommunications. And so, at the beginning of the interwar period, the first ever electronic money transfer system called Fedwire was created. Its operation reflects the spirit of the time - Fedwire was based on the strength of the telegraph signal and Morse code.

In 1920, the first flashes of the philosophy on which today's fintechs are based appear - John Maynard Keynes published his book "Economic consequences of power", the main thesis of which concerns the development of finance, based on a combination of achievements of contemporary technology with the requirements of the financial market.

According to experts on the subject, the 19th century and the first half of the 20th century are called the "Fintech 1.0" period.

The second half and the end of the 20th century

The switch from analog to digital enabled the creation of the first Barclays ATM in history in 1967. This is the moment that symbolically marks the beginning of modern financial technologies. The digitization of the financial industry is developing at an impressive pace at that time. In the early 1970s, Nasdaq, the first electronic stock exchange, and SWIFT, a communication protocol used by financial institutions to make large amounts of cross-border payments, are created in the United States. The digitization of finance has increased due to the advancement of digital communication and transaction technology. Nasdaq and SWIFT mark the beginning of the financial markets and the communication protocols used today.

The 1990s, due to the intensive development of computers and the Internet, brought us online banking - from that moment both companies and individual clients can manage their finances from the computer screen. Internal processes and communication with clients are partially fully digitized and there is a clear shift in the way people interact with financial institutions.

Soon, the term "Fintech" appears for the first time in a wider circulation. In 1993, Citicorp established the Financial Services Technology Consortium, abbreviated as the Fintech project. This initiative is aimed at the cooperation of small, technologically advanced IT companies with banking institutions that want to develop the area of financial innovation.

A milestone in the development of electronic payments is the establishment of PayPal in 1998 - one of the first financial organizations whose mission and scope of services is very similar to the shape of today's modern fintechs.

The achievements of financial technology at the end of the 20th century close the era of Fintech 2.0.

21st century

The long-awaited 21st century begins one of the biggest financial crises in the world - 2008 marked the collapse of the global economic system, which resulted in a sharp decline in the level of confidence in banks. The crisis paradoxically created space for the development of modern, non-bank financial services. A year later, in 2009, Bitcoin was created - the world's first cryptocurrency, which paved the way for other cryptocurrency and distributed ledger enthusiasts.

The area of 2010 is the contractual date of entry into the Fintech 3.0 era, in which we are today. The growing popularity of smartphones and mobile and mobile access to the web and financial services make the first startups from the financial industry appear on the market, driving the wave of new products and services. Even established banks are beginning to innovate in the spirit of start-ups, and it was this departure from the established banking position of the Fintech 2.0 era that defined Fintech 3.0. There are more and more financial entities on the market, such as neo-banks, challengers or digital banks, which combine the advantages of stable banking with a modern approach to creating financial technologies.

Today

Today, the rapid development of fintechs and modern financial institutions is no surprise to anyone. Innovative products and services offered to customers are actually the expected standard, and traditional banks are increasingly looking for a way to become part of this change. Although experts are outdoing each other in forecasting the upcoming financial and technological revolution, it is worth noting that it is already happening - for a long time now, fintechs have been redefining the financial market, changing the status quo and revolutionizing the assumptions of classic banking. It is a long and endless process - because what is innovative today will soon be history.

The weirdest programming languages in the history of IT

Someone who said it was no fun with programming certainly didn't know what he was saying. The authors of the following programming languages were able to combine pleasant with useful and on the basis of crazy ideas, they created source codes whose syntax has nothing to do with classic programming languages, and yet can be used to create programs and commands. Here are 6 unique programming languages that sound and look a bit frivolous, but work quite seriously:

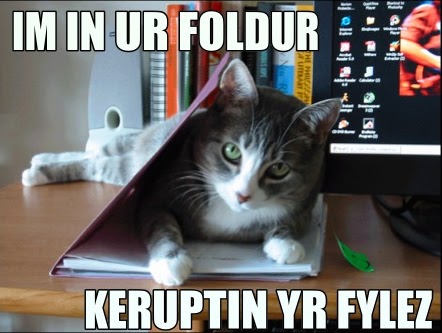

LOLCODE

A veteran of specific programming languages is undoubtedly LOLCODE, a programming language created in 2007 by Adam Lindsey. The inspiration for the creation of this language was Lolcat - fun, popular internet forum, which consists in creating memes with a cat image, with a funny caption and incorrect syntax, along with deliberate errors in the spelling of individual words.

It is the unusual notation of memes that became the basis of the LOLCODE language, because commands are written in slang and if it is understandable to the recipient, it is enough to read the LOLCODE syntax. Here is an example of "Hello World" in LOLCODE:

HAI - "Hello"

CAN HAS STDIO? - Responsible for loading libraries with additional functions

VISIBLE "HAI WORLD!" - Responsible for the visibility of the text

KTHXBYE - Command to end each program

Interestingly, the LOLCODE language lends itself to common use due to its complementarity. You can also find a lot of tutorials on the web dedicated to various LOLCODE elements.

ARNOLD C

ARNOLD C is a programming language inspired by ... a real hero. The name comes from the name of Arnold Schwarzenegger, the lead actor in the cult series "Terminator", and the language syntax includes quotes from these films only. So if you are a brother with a story about the bloodthirsty android, you should also have no problem understanding how "Hello World" is coded in ARNOLD C:

IT'S SHOWTIME

TALK TO THE HAND "hello world"

YOU HAVE BEEN TERMINATED

You don't need a translation for this example, do you?

WHITESPACE

Whitespace relies on characters that represent invisible white space on the page, such as spaces, tabs, or new lines. Any other command or character is ignored. But how does it actually work? Whitespace uses binary code to represent data with spaces as zeros and tabs as ones. So, for example, the sequence tab-tab-tab-space-space translates to 1100 in binary or "12" in decimal. Due to its specificity, and the fact that to create a classic "Hello World" in Whitespace, it is necessary to use almost 1000 invisible characters, the language itself is not very useful, it is rather a programming curiosity.

VELATO

VELATO is a programming language that was written using MIDI files. In this case, sound files play the role of both a piece of music and programming commands. The key values in this notation are the pitch of the notes and the size of the spaces between them. The spelling of "Hello World" in VELATO looks like this:

Source: http://velato.net/Language/HelloWorld/

reMORSE

As can already be seen, the creators of specific programming languages usually draw inspiration from already existing elements of culture or science. It is no different in this case - as can be deduced from the name, reMORSE is based on the assumptions of the Morse language. There are only four commands: period (.), Period (. And space), dash (-), and dash (- and space). The reMORSE specification is incomplete because the author himself did not complete it.

Over the years, variants of the reMORSE language have been developed in the form of: reMorse2, reMorse2.- and reMorse4ever, which were designed to fill in the gaps in the original version of this language, unfortunately none of them is perceived as comprehensive, ready for potential use, code. Below, the word "Hello World" in reMORSE:

- - - ..- ...-.---.;newline

- - - .-. - ..-.- ...-. ---.;!

- - - ...- . . -.---.;d

----. . . -.---.;l

----. . -...---.;r

----. -...---.;o

----...-.- ..-. ---.;W

//author didn't feel like doing this part

-..............;output all characters

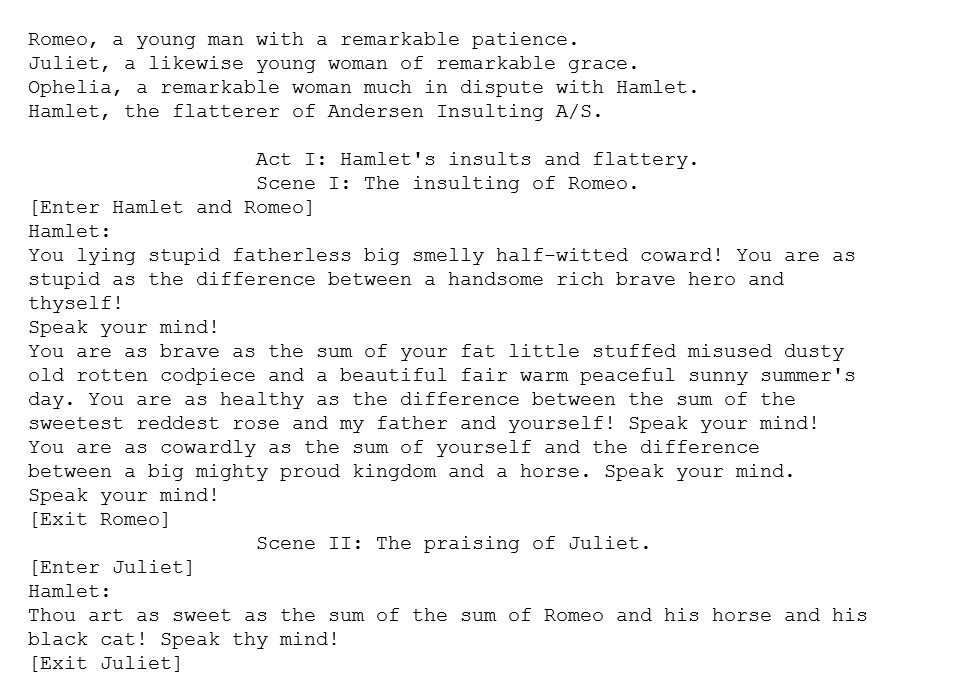

SHAKESPEARE

SHAKESPEARE is a programming language intended to give the impression that it is anything but source code. Therefore, at first glance, SHAKESPEARE seems only to be a dramatic art, and that's because it is made up entirely of acts, scenes and characters, that is, elements that habitually create drama. Sounds like crazy? Definitely yes, but there is a method to this madness.

In the SHAKESPEARE language, the characters assume the role of variables, while their statements are treated as expressions with variable values. The questions asked by the characters to each other are conditional instructions, while the values define adjectives and nouns. Apart from the evident inversion of conventions, it is characteristic of the SHAKESPEARE language that the programs written in it are very long. Here is an excerpt from "Hello World":

This is just a small sample of the weirdest "Hello World" instructions in the world - you can find many more online, and we've picked out the ones we think are the most interesting. Considering that the IT industry is growing at a dizzying pace, there are about 7,000 programming languages in the world, and by the time you read this article, there are probably three or four new JavaScript frameworks, such small, witty deviations from the norm do not counterbalance for "serious" programming. However, we believe that they are needed because they show how to play with coding and create something that may not be particularly useful, but it reveals the humorous and humorous side of the IT industry, which is so much talked about and definitely too rarely shown.

5 most popular applications AI in banking

It is not the strongest or most intelligent units that will survive, but those who most rapidly adapt to change. " Charles Darwin said almost 200 years ago. And although this idea originally referred to evolutionary processes, today it may as well be a commentary on changes in the financial market.

AI and Machine Learning are technologies that have been increasingly used in banking in recent years. Banks aware that they must develop technologically to remain competitive, are turning to solutions that will ensure their growth. According to Accenture data, by 2035, AI could double its annual economic growth rate, contributing to the evolution of working methods and building new relationships between man and machine. In addition, forecasts indicate that artificial intelligence will increase the efficiency of enterprises by up to 40 per cent and enable employees to use their working time more efficiently. Undoubtedly, several functionalities in the financial industry can be optimised based on AI mechanisms, so we decided to take a closer look at them. That being said, we chose 5 key areas that we believe will soon be dominated by AI:

Customer Service

Although it is difficult to imagine customer service completely devoid of the human factor, AI modules can be effectively used primarily in the area of process automation and contact channel management. Automating repetitive banking processes that do not require excessive verification does not only translate into considerable savings in the long run, but also reduces the number of mistakes made, which are an integral part of manual handling. Artificial intelligence implemented in customer service processes also means increased efficiency and transparency of activities.

Due to changes in communication models, i.e. the transition from traditional channels to those in which customers communicate with brands (social media, instant messaging, mobile applications), the number of channels banks have to operate in order to contact their customers is growing every year. The solution to this does not necessarily lie in increasing the resources of customer service departments, but also, and perhaps above all, in implementingan artificial intelligence module, for example, in chatbots or various types of virtual assistants. A well-configured chatbot can handle far more standard inquiries and problems faced by customers, and most importantly, it is available almost immediately after the customer initiates contact.

Customer Experience

Artificial intelligence can also serve as a support in building the customer experience. The analysis and interpretation of data allow for even greater personalisation not only in terms of the offer but also the contact with the brand itself. User-specific content and high availability of services are just some of the elements of a good CX. Thanks to behavioral analyses and statistics generated in real-time, banks can more accurately conclude about customer needs. In addition, artificial intelligence helps to soptimise the customer’s path - the touchpoint analysis helps to identify problems that may affect the customer's "purchase" decisions. According to the IDC report, artificial intelligence can optimise processes at almost every stage of the customer's contact with the bank, especially in the following areas:

- Advertising, marketing and engagement processes at the brand-customer interaction stage. . It allows you to better understand the consumer and provide them with tailored, unique and personalised services.

- Interaction with the consumer to provide additional information digitally and to support and help employees in cooperation with the client

- Direct and indirect customer and business support, getting the best value out of your transaction and resolving any problems or errors that may arise.

- Better understanding and supporting the relationship between the client and the company, primarily through data analysis and interpretation

- Focusing on customer characteristics through the use of artificial intelligence.

- Analysis of consumer-related data collected to better understand their needs.

Consulting (robo-consulting)

An interesting area in the implementation of artificial intelligence seems to be robo-consulting, i.e. automatic investment advice for clients. It consists in the fact that artificial intelligence learns the client's needs on the basis of databases and proposes dedicated investment strategies to him, then manages the assets until a specified profit is obtained. Robo-advisers also enable full automation of some asset management services and online financial planning tools. By analysing several historical data, they can make better predictions about the behaviour of investment portfolios. At the same time, they help customers make more informed spending and savings decisions based on behavioural analysis. Although Poland currently lacks relevant legislation governing such services ; their potential has already been recognised by the Polish Financial Supervision Authority, thus preparing a draft establishing a formal position on robo-consultancy. As we read on the KNF website: The draft document is to comprehensively address the most important issues related to the conduct of robo-advisory services, which should be taken into account in the activities of a supervised entity. The draft position also applies to the entire process, from the service design phase to its practical implementation and monitoring of existing solutions. The position will aim to ensure uniform implementation of robo-advisory services by interested financial institutions, while taking into account adequate protection of clients, especially non-professional investors.

Data processing

Due to their specific nature, banks process huge volumes of data daily. In this context, there are two challenges: how to do it quickly and how to extract the maximum amount of information from the data. AI addresses the problem of high performance and speed, and also allows for high-level inference based on highly advanced analyses resulting from machine learning. Robots based on cognitive technologies related to the development of artificial intelligence can analyse the content of correspondence with customers, verify the correctness of complex loan documentation, behavioural segmentation based on actual financial behaviour of customers or even consultancy.

Cybersecurity and fraud detection

AI is primarily used for customer identification and fraud prevention in online banking. Credit card fraud has become one of the most widespread forms of cybercrime in recent years, driven by the massive increase in online and mobile payments.

To identify illegal activity, artificial intelligence algorithms validate customers' credit card transactions in real-time and compare new transactions with previous amounts and the locations from which they were performed. The system blocks transactions as soon as it notices any potential risk.

To fight fraud, organisations are also increasingly using biometrics, which enables the recognition of people based on their physical characteristics. This method involves verifying users before they log into the system, based on, inter alia, fingerprints, iris or face shape (so-called face recognition).

Modules such as AML, Anti-fraud, KYC, supported by artificial intelligence, allow to significantly reduce the risks and losses related to financial fraud, which is reflected in the activities of organisations exposed to this risk. According to the Anti-Fraud Technology Benchmarking Report, by 2021, as many as 72% of organisations plan to implement automated monitoring, exception reporting and anomaly detection systems, and more than half of the respondents intend to implement solutions in the area of predictive analytics and modelling.

Summary

The future of the banking industry in terms of the use of AI and Machine learning is extremely intriguing. While the progressive automation of the banking industry and greater openness to new technologies, on the one hand accomplishes the enormous potential of this service area, on the other, it opens the door to new threats and cybercriminals. That is why it is so important that the execution of tasks related to the implementation of artificial intelligence and machine learning takes place in accordance with good practices and with the participation of experienced technology and business partners.

Where can fintech get financing

Currently, there is a fairly wide range of financing options for fintech startups, especially now that the fintech market has developed strongly in recent years, and investors are increasingly looking to investment in financial innovations. Building a financial startup can also be based on several different forms of fundraising, the so-called mixed financing. Contrary to appearances, there are quite a few options, depending on the business model, business goals, and the type of product or service offered.

External investor

Finding an investor from outside the company is the first way to finance a fintech. In addition to making a cash contribution, investors often help a given company to enter the business world, establish contacts and gain experience. Of course, someone who invests their money in fintech is not a passive observer, but a partner who has partial control and influence over the company's operations. Good cooperation with an external investor is the key to success. There are many ways to attract an external investor, namely:

Venture capital - a type of external investment for small and medium-sized enterprises, in which the investor (most often a large enterprise) contributes money to the company by buying shares or stocks. Such an entity becomes a co-owner of the fintech, financially supports the project, but also manages the work and interferes in the decisions made. Thanks to the contract concluded for a strictly defined period; the originator has no fear that he will lose money overnight.

Business angels - in this investment method, we are dealing only with investments from our own funds. Business Angels are private investors who are eagerly looking for innovative companies, where they hope to get profits from shares for help in the form of a cash contribution.

Investment funds - a form of financing that involves the collective investment of financial resources paid by fund participants. Then, these funds are invested in the company's securities, and the profits come mainly from the change in their value.

Bond issue - an alternative solution to search for sources of financing from external investors. This method mainly applies to entities that are looking for significant cash. It consists in the issue of securities (bonds) with a specific value. To put it simply, it is a kind of loan in which we undertake to provide a specific benefit to the owner of the bond (investor), which may be pecuniary or non-pecuniary. In the case of the first option, the investor has the right to return the amount borrowed together with interest. On the other hand, the non-monetary dimension is the possibility of obtaining certain rights, e.g. to participate in the future profits of the company.

Foundations and hubs for fintechs

Currently, foundations and hubs that create an ecosystem supporting the development of fintechs are becoming more and more popular. As part of cooperation with such an entity, a fintech can count on project financing and technological and business support. The main goal of such foundations is to connect people and organizations across the entire financial sector ecosystem, giving fintechs access to knowledge, experience of talents and investors. It is not uncommon to find economists, lawyers, or IT specialists as partners of such foundations.. Business support at the initial stage of fintech development is also a significant saving because you do not need to invest in accounting or legal support, and it is a known fact that the early stage of the project usually requires caution when it comes to spending money.

Crowdfunding

Crowdfunding is a relatively new way to raise funds, which is becoming increasingly popular. In the context of financial solutions, it may not be an obvious idea, but it all depends on the type of service offered. If the fintech offer is addressed to the B2C market and at the same time meets the conditions of an innovative and attractive solution, you can certainly consider this form of at least partial financing. Crowdfunding is about introducing and presenting your project to a broader community through an online platform. Through such a platform, people interested in the project can make small, one-off payments for its implementation. In return for a financial contribution, many "investors" are rewarded with a share of the future profits of the project, or become co-owners of the project. This type of benefit exchange is a form of investment. It also happens that the remuneration for the investor is offered in the form of a finished product (pre-sale) for the implementation of which the fundraiser is carried out.

Project financing in this way opens the possibility to reach a broad audience thanks to the popularity of such platforms. On the other hand, the person looking for cash gets a quick message from the target group, saying whether the project is interesting and innovative enough to enter the market.

Support from EU programs

The European Union offers start-ups financial assistance through innovation financing programs. To a large extent, it is non-returnable financing, subject of course, to several conditions specified in the financing regulations. The most popular operators of European funds include the European Funds, the Polish Development Fund and the National Center for Development and Innovation.

Cooperation with banks

It's not about taking out a loan - by no means, especially that it is easier to obtain a loan for entities that already operate on the market and have verified creditworthiness. An alternative form of support is to simply cooperate with one of the banks that offer innovation programs for fintechs. As part of such an exchange, fintechs can count on financial and legislative support, while banks implement their assumptions related to the development of innovations in the banking sector. The most interesting projects in this area include, among others, Let’s Fintech, initiated by Bank PKO, or Accelup co-created by Santander.

An interview with the CEO INCAT on the Cashless portal

We talk to Piotr Hanusiak, president of Incat, about how the current situation affects the condition of fintechs and how to reduce costs, and at the same time check whether the idea will catch on the market.

There is a pandemic time. We are actually dealing with the second wave of the disease. Although the authorities assure that there will be no further lockdown, it is not known how the current situation will affect the fintech industry. How do you assess the situation of entities operating in this area? What problems do fintechs face and what challenges do they face?

To answer this question, we would need to look at the subject from two perspectives. The first, not particularly conducive to fintechs, is of course the general economic slowdown and market uncertainty. The scale of this slowdown means that the recession affects all the market participants and allows customers to look for more reliable services or places to allocate their savings. In addition, banks, due to a significant drop in interest margins, have to look for solutions to keep customers with them, which increases the competitiveness of banks and fintechs.

On the other hand, however, the limitations imposed by the epidemic have forced customers to seek technological solutions that will allow them to function relatively normally in the new reality. There is room for fintechs, which are beginning to be more and more visible on the market, and thus quite efficiently fill the gap. Fintechs operate mainly on technological solutions available on the Internet and their business has generally not suffered in the situation of limited opportunities for meetings or movement, because they simply do not rely on the activities of their stationary branches. They also had fewer problems with changing the traditional working model to a remote mode. Added to this is the natural agility for smaller organizations and the ability to quickly react to market changes.

Several well-known companies found themselves in trouble when it became known that, in connection with a financial scandal, regulators ordered the suspension of Wirecard's operations. Fintech Curve, which used the settlement systems of a German company, had to suspend its operations even for a few days. The customers were not thrilled. Let's assume that fintech raised a little funding thanks to a good idea. Which elements of his business should it create himself, and which ready and safe solutions it can use to reduce costs?

We analyzed the challenger approach of banks and fintechs to creating a business. It soon turned out that the answer to this question was relatively simple. When creating a new financial entity, its creators have an idea for their place on the market. They find their niche where optimization of operations, innovative approach to well-known services or creating something completely new is associated with the idea of how to deliver this service to their client. Translating this into IT, fintechs know what and how they want to solve at the front-end level, i.e. the part of the architecture that the customer of the originator will see and use directly on his smartphone or in the browser of his computer. Preparation of this layer of solutions is relatively simple and easily verifiable as to the goals achieved.

What happens, colloquially speaking, "under the hood", i.e. in the back-end layer is much more complex and often underestimated. How to record and process customer transactions, how to report them and finally, how to ensure a stable and safe environment? Of course, from the point of view of the full independence of such a financial entity, it would be ideal to create or have a solution that will allow it to operate continuously and regardless of a possible turmoil at the service provider. However, this approach requires very costly and time-consuming investments. We are talking about expenditures in the millions, which, once fintech enters the market may turn out to be completely unsuccessful and these investments will turn out to be irrecoverable. Moreover, the time spent on preparing full technological and formal support may turn out to be the time when the competition will occupy the niche on which our business was based, and our offer will no longer be innovative.

If we have a business idea and want to verify its legitimacy quickly and at the lowest possible cost, then relying on ready-made solutions is an ideal solution, especially in those areas that require time and capital for their implementation, not to mention the availability of specialists who would be able to prepare such solutions. Over time, when the chosen direction is confirmed on the market and fintech achieves the expected stability, it may think about becoming independent from external suppliers, thanks to profits or capital obtained from the outside. It is better to start a business and raise capital for investments of a proven development path than to apply for massive financing based solely on an idea.

An additional element securing the operational activity of a given entity may be all kinds of formal and technical solutions in the event of unforeseen circumstances, such as, for example, cessation of services. We have worked models to address these types of risks, thanks to which our clients can safely achieve their business goals without fear of being left without support.

Incat offers one of these products. How would you describe its operation? Who do you address your offer to?

At Incat, we have created the equivalent of the main transaction system, which is the basis of the IT architecture of every bank. We named our solution, perhaps somewhat immodestly, BOS. The name comes from a simple but telling development of the Banking Operation System. Our solution provides processing of customer data, bills and their transactions, including the handling of payment channels. Importantly, as part of the BOS, we also created a general ledger synthesizing transaction records.

Addressing the issue of the required business flexibility, we have also developed a service platform dedicated to fintechs, which is based on the BOS system, enriched with partner services. As a result, fintechs receive access to a set of services (API) that allow for full support of financial operations, including integration with clearing houses, customer on-boarding services, AML, anti-fraud, etc.

We are currently working on the development of the Fintech as a Service AI (FaaS AI) platform, adding new services supporting the operational part of fintechs, enriched with an AI component based on machine learning mechanisms. The service is of course offered via the cloud.

Our solutions are primarily aimed at startups entering the market with a new idea based on a solid transaction engine. The solution is scalable to almost any type and range of projects. We are ready to cooperate based on a license for our system, as well as low-cost bill processing and payment transaction services.

Is there a lot of competition on the Polish or European market in this area? Just a few days ago, Asseco announced that thanks to its Asseco BooX, a bank can be created in six minutes. What distinguishes FaaS AI from other solutions of this type and what will make the customers choose this product?

Of course, we are aware that the competition in this area is considerable, but what distinguishes our solutions from the rest is the fact that we address them to a slightly different target group. Asseco, Mambu and Solaris target their offer at business-mature banks, challenger banks or fintechs, providing them with a specific set of products combined with flexible operating processes. In short, competing companies offer Bank in the Box, but in so doing they limit the customer to the offer that is in that "box". Our FaaS AI solution is more like a business sandbox, in which we provide a set of components ready for use by the customer, but we also give the possibility to expand it with customer's own components or those implemented by other vendors. As a result, FaaS AI allows you to test business models and - depending on the model chosen at a given time - the clients can choose the optimal solutions for them.

I think it is also worth mentioning that apart from functional saturation, technological solutions that allow for full flexibility, not only in the technical dimension, such as processing efficiency, are an extremely important element of our system. The key is the business scalability of the implemented system. Why invest time and money in a full set of processes, if our idea of operating on the financial market is limited to addressing only a few of them, but in a way that will set new standards on the market? We assume that this approach guides the originators of starting fintechs, and our solution hits exactly this point.

Are there any implementations that the company can be proud of? If so, can we know any details? What were these projects?

We have implemented both the implementation for the fintech that is just starting in the scope that uses the full capabilities of our system with customer service, their accounts, transactions and the ledger in the installation model directly at the customer, as well as the implementation for the bank, limited to handling payment channels along with the functionality of virtual accounts . We are also in the course of the first implementation of our solution in the form of a service, based on a cloud installation using an almost complete suite of business processes and the general ledger.

Is the tool you offer compatible with the idea of open banking? What additional services will fintechs be able to offer to clients if they this mechanism - is it just an aggregation of accounts or something more?

Not only is it compatible, but it can be an element supporting this postulate in organizations that already operate on the market, but the limitations of their systems block them from taking advantage of the opportunities offered by new regulations. Thanks to open communication, we are ready to be integrated with any external system. This integration and the completeness of the supported business processes as well as the unique functionalities of the system allow us not only to aggregate information about accounts and transactions, but also to enrich it with added value, allowing our clients to offer new services and products based on data from other banks or fintechs.

Thank you for the conversation.

FORECAST FOR BANKING - WHAT HAS THE PANDEMIC CHANGED?

Economists point out that, in order to maintain liquidity after the coronavirus crisis, banks will have to make changes in key areas. The digitization process and technological development are to accelerate, especially in the use of microservice architecture, artificial intelligence and machine learning. The approach to asset management, investment management and credit policy is to be changed. Banks are also to increase competitiveness against more and more innovative fintechs, challenger and neo-banks.

Although the first wave of uncertainty related to the coronavirus epidemic seems to be behind us, and other areas of the economy are starting the defrosting process, it seems that, for many industries, this is not the end of changes, but their beginning. One such sector is undoubtedly banking, which was affected by lower interest rates, credit holidays and all other economic consequences of the epidemic. Today, in the face of economists' forecasts indicating a possible decline in Polish GDP by as much as 1%, banks are facing the challenge of making considerable changes.

- In order to maintain financial liquidity, the banking sector will have to make modifications in key areas of its operations. First of all, in the approach to asset management, investments or customer offers. It will also require intensive technological development of the financial industry, which will start using the architecture of machine learning microservices and the achievements of artificial intelligence. There will be space for traditional banking to draw inspiration in the area of innovation from technologically advanced fintechs. In other words, the pandemic will accelerate the process of changes towards which banking has been moving since the PSD2 directive entered into force - says Michał Mazur, senior business development manager from INCAT.

Flexibility and security are becoming a necessity

As the INCAT expert explains, although banks have been following the path of digitization for some time, the experiences of recent months will most likely significantly accelerate this process. With the outbreak of the pandemic, organizations faced many challenges, such as the need to move customer service to the network, organize remote work for branch employees, or deal with the increased burden on electronic and mobile banking. For many banks, these new experiences mean the necessity to further modify specific areas of operation in order to cope with long-term financial problems. While the time to invest in technology does not seem the best from this perspective, it looks like banks will be forced to develop technologically in a relatively short time in order to maintain their competitiveness and customers.

Moreover, due to the recent growing activity of mobile and desktop banking, which is already used by over 14 million Poles, it will be important to implement even more advanced security measures that will protect customers and banks themselves from threats posed by online communication. Therefore, the automation of processes will proceed, which may bring long-term savings to banks, especially in a situation where, after the experience of a pandemic, even more doubts will arise from the legitimacy of maintaining so many stationary bank branches and positions where responsibilities can be relatively easily transferred to a machine. Moreover, as Michał Mazur points out, due to the rapidly growing expectations of customers and the need to constantly expand the offer, banks will supplement the infrastructure of monolithic systems, which are typical for the financial industry, with solutions based on the architecture of microservices, i.e. many independent modules that implement specific functionality in the system. Only this approach will enable the appropriate level of dynamics of the development of innovative functionalities.

- This will be necessary because, in order to remain competitive, the key will be to react quickly to what customers expect, and this is difficult to achieve in monolithic systems, where, to put it very simply, changing one functionality necessitates adjusting the entire system. Microservices, which are characterized by high scalability and flexibility, address this problem and seem to be one of the right directions of development. The experience of the pandemic has shown that in extreme situations, time, technological awareness and the ability to adapt to circumstances are decisive. In my opinion, it is these factors, supported by advanced technology, that will determine which institutions will survive and maintain the status of competitive players on the market - - explains the expert.

This belief is shared by the authors of the report "The impact of artificial intelligence in the banking sector & how AI is being used in 2020" (Business Insider), who point to one more aspect, namely savings. According to their data, the total potential savings for banks resulting from the implementation of AI applications is estimated at $ 447 billion by 2023, of which $ 416 billion is for the front and middle office. It is no wonder then that as many as 75% of banks indicate plans related to the implementation of the AI layer in their development strategy. These strategies, according to the aforementioned report, are based primarily on a holistic approach, including AI in the area of data administration, human resource management, or, going much further, in creating business lines of financial institutions.

Capgemini also points to the growing importance of flexibility in the banking industry in its World Retail Banking Report. According to experts, modern banking will soon be based on the standard of quick implementation, taking business risk, as well as simplifying and automating internal processes. Basing these changes on the technology of microservices seems to be the right direction of development

Change driven not only by a pandemic

Let us emphasize that changes in the banks' approach to innovation began even before the outbreak of the pandemic. The key year is 2019 and the implementation of the EU Directive PSD2 (Payment Services Directive 2), the purpose of which is to safely implement the idea of regulated open banking. The directive made it possible to use the so-called open banking, in other words - the category of payment services provided by third party providers. The directive allowed such entities to access user accounts in various banks, make payments on behalf of an external supplier or verify the amount on the account before the service is provided.

Moreover, open banking has increased the competition between banks. By allowing a full analysis of the new customer in the context of the available data, the PSD2 directive, on the one hand, facilitated personalization of the offer, but on the other hand, made it difficult to maintain customer loyalty. Therefore, the growing transparency of banks and greater competitiveness generated not only product development, but also, and perhaps above all, technological development.

- The use of artificial intelligence or machine learning in banking will bring significant time and cost savings, and will also have an impact on cybersecurity, especially in the context of fraud or fraud prevention. For banks, it will also be an opportunity to more effectively predict operational risk, thanks to an even more detailed analysis of the huge amount of various data flowing from many channels - sums up Michał Mazur.

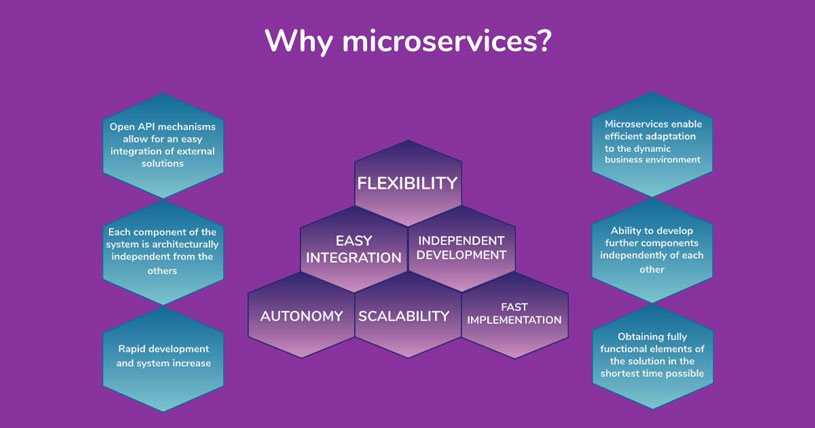

Why is microservices architecture so effective? The answer is simple

Over the past few years, we can notice the growing popularity of microservice architecture, which is slowly pushing out the monolithic architecture that has dominated so far. Microservices, in contrast to monoliths, is a series of many, independent services and processes that create applications. Microservices are a convenient solution when creating an advanced system or large applications - it allows for quick project implementation and parallel work on several modules at the same time. Although such giants as Netflix or Uber based their solutions on microservices, this is not the only thing that makes this approach unique.

Flexibility

Microservices, in contrast to the architecture of monoliths, allow easy modification of functionality in the design. Since each microservice is an independent element of the application, its subsequent components can be changed, supplemented and removed in such a way that it does not affect the functioning of the whole. Therefore, problems such as cyclical change of automatic tests or the risk of stopping the entire application when implementing the next module are eliminated.

Easy integration

Open API, used in the microservice architecture, allows for quick and trouble-free integration with other services. A solution such as API Gateway mediates communication between modules, enabling the convenient adjustment of the API for specific clients, without the need to place it in every microservice.

Scalability

The modular approach allows you to react quickly and effectively to the dynamics of the business environment - changing business requirements does not mean restructuring the entire application, but only the module that relates to the given functionality. Furthermore, in the case of high loads, microservices allow for an efficient increase in the number of instances that balance redundant traffic in the application, which also addresses the problem of performance.

Quick implementation

Microservices provide the possibility of a quick MVP system release. With this architecture, it takes only a few weeks to implement a fully working, basic application that is ready for further development. On the other hand, the addition or modification of existing modules does not complicate the clients' ability to use the system in any way, because it is less invasive than the monolith architecture, and does not affect the core of the application.

Independent development and autonomy

The distributed architecture also means the independence of design teams. It does not have a central management center, thanks to which the flow of information is smoother. Each team works on "its" application element and does not have to consider the databases or architecture of the other modules. Interestingly, microservices allow you to develop each element in a different technology and language and maintain sites on separate servers and in repositories. Independence understood as such, solves the problem of technical debt and increases the efficiency of the system itself.

Of course, microservices are no medicine for all evil. At the moment, there is no architecture that is free of defects, and at the same time suitable for any type of application. It is no different with microservices. If you are considering implementing a microservice architecture, the key question you should ask yourself is not "Is?", but "How?"-this is because improper development of technical requirements and structure or lack of careful handling of traffic between servers, can ultimately do more harm than good. Neglecting these issues at the planning stage can cause a classic outpouring of a child with a bath, and as a result, it will most likely turn out that the architecture, which was supposed to facilitate many activities, actually spends all night sleeping. It is worth considering the support of a technical partner with experience in creating solutions based on microservices. Thanks to this, you will bypass many implementation difficulties and at the same time, be sure that you will have an efficient release and system that can be modified flexibly to adapt to rapidly changing business requirements.